Image source: The Motley Fool.

AtriCure Inc (NASDAQ:ATRC)Q4 2018 Earnings Conference CallFeb. 28, 2019, 4:30 p.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Good afternoon, and welcome to AtriCure's Fourth Quarter 2018 Earnings Conference Call. At this time, all participants are in a listen-only mode. We will be facilitating a question-and-answer session toward the end of today's call. As a reminder, this call is being recorded for replay purposes.

I would now like to turn the call over to Lynn Lewis from Gilmartin Group for a few introductory comments.

Lynn Lewis -- Investor Relations

Thank you. By now you should have received a copy of the earnings press release. If you have not received a copy, please call 513-755-4136 to have one emailed to you.

Before we begin today, let me remind you that the Company's remarks include forward-looking statements. Forward-looking statements are subject to numerous risks and uncertainties, many of which are beyond AtriCure's control, including risks and uncertainties described from time to time in AtriCure's SEC filings. AtriCure's results may differ materially from those projected. AtriCure undertakes no obligation to publicly update any forward-looking statements.

Additionally, we refer to non-GAAP financial measures, specifically revenue reported on a constant currency basis and adjusted EBITDA and adjusted loss per share. A reconciliation of these non-GAAP financial measures with the most directly comparable GAAP measures is included in our press release, which is available on our website.

With that, I'd like to turn the call over to Mike Carrel, President and Chief Executive Officer. Mike?

Mike Carrel -- President and Chief Executive Officer

Thanks, Lynn. Good afternoon, and thank you for joining us everyone. We are pleased with our fourth quarter results and performance throughout 2018 and we continue our track record of strong consistent revenue growth. We achieved many milestones and accomplishments in 2018. We completed enrollment in the CONVERGE IDE trial, trained over 400 healthcare professionals worldwide, surpassed 170,000 atrial fib devices sold, launched the AtriClip FLEX V device, established a dedicated pain management team and raised over $80 million, strengthening our balance sheet and creating financial flexibility.

2018 was also a foundation building year. We are maturing as a team with more than 150 people in the field, robust training education programs and a leverageable infrastructure across our entire organization, so that we can efficiently scale. We believe the maturation of our teams is reflected in our performance this year, underpinned by our commitment to education, clinical science and innovation as the cornerstones of our success. With this and as previously announced, we expect full year 2019 revenue in the range of $220 million to $228 million.

Now turning to our fourth quarter performance. Total revenue for the fourth quarter of 2018 was approximately $53 million, reflecting growth of 15% over the fourth quarter of 2017. This was highlighted by US revenue of $43 million and growth of 19% to Q4 of last year. Our top line performance was driven by strong sales across our key ablation and appendage management products.

Within our appendage management franchise, we believe we are seeing continued signs that the market opportunity remains strong. Surgeons and other conditions are increasingly recognizing the need to manage the appendage. Our AtriClip products work effectively as they work consistently becoming the go-to-choice for many surgeons. We are also receiving steady positive feedback on our innovative approach to advancing products in this franchise to meet clinical needs. Our approach in conjunction with evolving market dynamics is collectively driving our confidence in this platform and its potential. We are seeing everything from the AtriClip, FLEX V device being used in open cases enabling more CABG procedures to seeing greater uptake in convergent procedures. As a reminder, we originally thought the AtriClip attachment rate in convergent will be less than 5%. However, we are currently -- we currently believe it is over 30%.

Turning to our open platform. Evolving guidelines and emerging clinical data are driving changing behavior. Patients live longer and do better with surgical ablation, it is that simple. This fact is making an impact, driving steady demand for training and increasing adoption. Throughout 2018, our courses were full and we expect the same in 2019. As part of our commitment to developing clinical evidence, we are investing in the ICE-AFIB clinical trial. ICE-AFIB will evaluate the safety and effectiveness of the cryoICE Ablation system for the treatment of persistent and long-standing persistent atrial fibrillation during concomitant cardiac surgery. The trial is a prospective, multicenter, single-arm study of up to 150 patients at up to 200 -- up to 20 centers in the United States enrolling patients with persistent and long-standing persistent atrial fibrillation undergoing cardiac surgery procedures for heart valve repair or replacement and/or coronary bypass procedures.

Primary effectiveness is defined as freedom from Afib, atrial flutter and/or atrial tachycardia lasting greater than 30 seconds and will be evaluated at 12 months after the procedure. Long-term effectiveness will be evaluated at three years post procedure. On that note, we are pleased to announce the first patient in the ICE-AFIB trial was enrolled in February this year.

We view the ICE-AFIB trial as unique opportunity to generate systematic clinical evidence on the safety and effectiveness of concomitant (ph) cryosurgery for the treatment of Afib patients undergoing structural heart surgery. Within our MIS business, we had solid performance in Q4. More than 200 sites have now done convergent procedures in the United States. As a reminder, the convergent procedure is a multi-disciplinary therapy in which a close chest upper cardioablation is performed by a surgeon, complemented by an endocardial catheter performed by an electrophysiologist.

The CONVERGE IDE trial is the first of its kind evaluating the convergent approach against catheter ablation for patients who suffer from the most serious forms of Afib. As a reminder, we completed enrollment in the CONVERGE IDE trial in August 2018. Our next milestone will be completion of one-year patient follow-up, which we expect in the second half of 2019, followed by a submission to the FDA for pre-market approval of the AtriClip EPi-Sense -- for Atricure EPi-Sense system for the treatment of persistent Afib using the convergent approach.

We expect to be in a position to disclose the data from the trial in 2020 in support of our anticipated FDA panel meeting as part of PMA process. We are also pleased to announce that we have received approval from the FDA in the fourth quarter to expand our deep AF IDE clinical trial to include an additional 40 patients. The DEEP AF trial provides another alternative for minimally invasive approaches and we look forward to providing updates as the trial advances throughout 2019.

Switching gears to pain management. We recently announced the launch of CryoICE CryoSPHERE probe in the United States. The cryoSPHERE Probe is the first device in the cryoICE platform solely dedicated to blocking pain by ablating peripheral nerves, temporarily blocking the nerves from transmitting pain signals. The block typically lasts several months during which time the nerve regenerates. Because of the nature of the therapy, physicians are adopting cryo nerve block or cryo NB therapy as a key part of their pain management strategies, offering a unique solution for patients undergoing cardiothoracic surgery. More than 80 cases have been performed with the cryoSPHERE probe, and surgeons are noting remarkable improvement in post-operative recovery times, post-operative pain levels and patient satisfaction. We believe that cryo nerve block therapy with the cryoSPHERE probe also has the potential to contribute to combating the opioid epidemic.

One recent study showed that 14% of patients undergoing surgery for lung cancer become persistent opioid users. The cryoSPHERE probe has the potential to reduce the need for long-term narcotic use postoperatively and thereby reduce the very real risk of addiction and abuse. Last year, we established a small dedicated thoracic team to support the cryo nerve block therapy in select markets. We are seeing the early impact of these efforts. And in 2019, we will expand this team as we move forward with commercial launch of the cryoSPHERE probe. Further, in support of this franchise, we are on track to complete enrollment in our FROST study in the near future.

There are also other clinical studies being done by independent clinicians who are committed to developing the evidence for this novel therapy. Looking ahead in 2019 and beyond, we are excited about the opportunities across our entire product portfolio and are committed to continuing innovation to deliver benefits to patients worldwide. Internationally, our revenues were up 1%, constant currency for the fourth quarter. Our overall growth rate outside the United States was impacted by the fact that we did not taken order from China in the fourth quarter. In Europe, we saw steady progress throughout the year, culminating in a top line of 18% growth in the fourth quarter with solid sales of the EPi-Sense device across the region.

We are very encouraged by the maturity and cohesion of the European team and look forward to maintaining this momentum in 2019. In Asia, we continue to experience strength in Japan, which we expect to transfer into 2019 with both the AtriClip and the cryoICE platforms established in the market. Our partnership with biopharmaceutical group in China is continuing to progress with several new sub-distributors on board.

Turning finally to our investments in training and education. In 2018, we conducted a record number of training sessions both in the US and Europe, training more than 400 healthcare professionals and providers worldwide. During the year, we also significantly increased our cadaver labs at the Maze IV courses to enable hands-on experiences. Through these courses, more than 100 cardiothoracic surgery fellows were trained, exceeding our expectations and target for the year.

In January 2019, at the 24th Annual International Afib symposium in Boston, we received overwhelmingly positive feedback. We also learned that our advanced ablation course has received endorsement from the Society of Thoracic Surgeons. We are confident support from these from leading medical institutions and societies, coupled with education awareness, will lead to more patients getting access to care that extends and improves their lives.

With that, I will now turn the call over to Andy Wade, our Chief Financial Officer, and we'll turn for comments at the end.

Andrew Wade -- Senior Vice President and Chief Financial Officer

Thanks, Mike. For the fourth quarter of 2018, worldwide revenue increased 14.8% on a GAAP basis to $52.9 million. On a constant currency basis, worldwide revenue increased 15.3%. Revenue from product sales in the US was $43.1 million, an increase of 19.1% from the fourth quarter of 2017. Revenue from open chest ablation related procedures in the US, increased by approximately $2 million to $18.6 million, representing growth of 11.9%, driven by increasing volume across all open chest ablation products were particularly strong results from the Cryoablation platform.

US sales of ablation products used in minimally invasive procedures were up 13% to $9.4 million, driven by a robust quarter for the AtriCure EPi-Sense system. US sales of appendage management products during the fourth quarter of 2018 were $14.5 million as compared to $10.6 million for the fourth quarter of 2017, an increase of 36.3%. Growth was very strong for both the open and MIS AtriClip product platforms, we continue to be pleased with the performance of our AtriClip V products, especially the number of AtriClip FLEX.V devices used in open procedures.

International revenue totaled $9.8 million, down 0.9% on a GAAP basis and up 1.4% on a constant currency basis as compared to the fourth quarter of 2017. The fourth quarter results reflect no revenue from China, as we continue to transition to a new distributor -- distribution partner. We expect to have a more normal order pattern from China throughout 2019. In the rest of the international business, we saw strong growth throughout Europe, driven by the UK, Germany, and several of our larger distributor markets .

Gross margin for the fourth quarter of 2018 was 73% as compared with 71% for the fourth quarter of 2017. The primary driver of the improvement was the change in geographic mix. US sales represented a larger percentage of worldwide sales in the fourth quarter of 2018 than in Q4 2017. Pricing continues to remain steady across both our product lines and geographies with a small portion of overall favorability driven by our AtriClip V platform being sold in incrementally higher ASP. In the fourth quarter, we had positive adjusted EBITDA of approximately $300,000 compared to a $300,000 adjusted EBITDA loss for the fourth quarter of 2017.

Our operating loss for the quarter was $2.6 million compared to the operating loss for the fourth quarter of 2017 of $2.1 million. Our loss per share was $0.09 for the fourth quarter of 2018 compared to an $0.08 loss per share for the fourth quarter of 2017. Note that this $4.1 million non-cash credit to operating expenses was recorded in Q4 2018 related to the change in contingent consideration liability. For Q4, 2017, we also recorded a $4.1 million non-cash credit related to this liability. Without these non-cash credits to operating expenses, our adjusted loss per share for the fourth quarter of 2018 was $0.21 compared to an adjusted loss per share of $0.20 for the fourth quarter of 2017.

Note that adjusted EBITDA results for 2018 and 2017 both exclude non-cash adjustments related to this contingent consideration liability. Operating expenses increased approximately $6.4 million from $38.9 million for the fourth quarter of 2017 to $45.3 million for the fourth quarter of 2018 excluding the impact of the non-cash adjustments to the contingent consideration liability. Research and development expenses, which include clinical and regulatory activities, were $8.5 million for the fourth quarter of 2018 or 16% of sales, an increase of $700,000 from the fourth quarter of 2017.

The increase was driven primarily by personnel-related costs and development efforts with the reduction in spending for clinical trials, partially offsetting this increase. SG&A expenses, excluding the non-cash adjustments previously described, increased approximately $5.7 million from the fourth quarter of 2017 to a total of $36.9 million or 70% of sales. The increase results from our continued investment in the commercial organization worldwide, an increase in share-based compensation and legal costs with some offset for lower costs related to marketing and training activities.

For the full year 2018, worldwide revenue was $201.6 million, an increase of 15.4% or $26.9 million over 2017. On a constant currency basis, growth was 14.9%. For the US, sales grew 17.2% to $162.1 million. US open chest ablation revenue grew 12% to $72.2 million. US sales of ablation products used in minimally invasive procedures increased 1.8% from 2017 to $35.1 million, driven by increased sales of EPi-Sense products, but offset by slightly lower revenue from other MIS products.

US sales of appendage management products grew 41.9% to $52.9 million, driven by strong performance of both open and MIS AtriClip products. International revenue grew 8.7% on a GAAP basis or 6.1% on a constant currency basis to $39.5 million. European growth was strong in 2018 balancing weaker results for Asia, driven by the China distributor transition. Gross margin was 73% for 2018 compared to 72.2% for 2017. Loss per share for 2018 was $0.62 compared to $0.83 for 2017 and the adjusted EBITDA loss was $2.7 million for 2018 compared to $5.3 million for 2017.

Our adjusted EBITDA loss for 2018 and 2017 both exclude non-cash adjustments related to the contingent consideration liability. Without these non-cash adjustments, the 2018 adjusted loss per share is $0.94 and the 2017 adjusted loss per share is $0.96. We ended the year with approximately $124 million in cash, cash equivalents and investments. In addition to the offering that we completed in October that netted approximately $83 million in proceeds, we also recently amended our credit facility with Silicon Valley Bank, reducing our overall cost of debt.

We are planning to file an updated shelf registration with the SEC concurrent with our 10-K filing, as our current shelf is set to expire in June of this year.

Lastly, we are providing guidance for 2019. We anticipate top-line growth of approximately 9% to 13% year-over-year or worldwide revenues of approximately $220 million to $228 million on a GAAP basis. We anticipate gross margin to be approximately 73% to 74% for the year, as we progress toward our long-term goal of 75% gross margin.

The improvement will be driven by both mix changes and cost control efforts. We expect R&D expenses to be 17% to 19% of sales. Investment in this area include the ICE-AFIB and DEEP AF IDE trials, new and developing clinical science activity along with R&D pipeline development. We expect SG&A expenses to be approximately 66% to 69% of sales in 2019. The increase in SG&A expense is again driven by thoughtful expansion of our worldwide sales team as well as increasing investments in training and education with continued leverage in the general and administrative areas.

We expect adjusted EBITDA for 2019 to be positive with the range of $0 to $3 million, improving from the adjusted EBITDA loss reported for 2018. This translates into a loss per share between $0.68 and $0.78. As we reported quarterly for 2018 in years prior, we anticipate adjusted EBITDA results will improve as the year progresses. Therefore, while we expect full-year adjusted EBITDA to be positive, we typically experience heavy expenses earlier in the year and expect to generate an adjusted EBITDA loss in the first quarter of 2019 of approximately $1 million to $2 million. This adjusted EBITDA loss for the first quarter of 2019 translates to a loss per share in the range of $0.22 and $0.25. Again, we expect to deliver positive adjusted EBITDA for the full year 2019.

At this point, I would like to turn the call back to Mike for closing comments.

Mike Carrel -- President and Chief Executive Officer

Thank you, Andy. In closing, we remain confident that our fundamentals and business outlook remains strong. We're extremely pleased with our fourth quarter performance and our track record of sustained double-digit top-line growth. Looking ahead in 2019, we continue to focus on the three pillars critical to our mission, which are education, clinical science and innovation.

We have created a strong foundation and culture that fosters a patient-first mindset and positions us well for the long term. We are deeply committed to improving the lives of Afib patients globally and remain steadfast in our efforts and are confident the investments that we've made set us up for strong growth over the next decade.

With that, we'll now open up to questions. Operator?

Questions and Answers:

Operator

(Operator Instructions) Our first question comes from Rick Wise with Stifel.

Rick Wise -- Stifel -- Analyst

Hi guys. It's (inaudible) on for Rick tonight. But I just -- first, thanks for taking the question. But just to start on guidance. Can you just talk about the puts and takes for your 9% to 13%. It's a little bit wider than maybe your initial guidance was last year? Can you just maybe help us with some of the assumptions there that get us to the higher and lower end of the range?

Andrew Wade -- Senior Vice President and Chief Financial Officer

Yeah, I mean there's nothing specific (inaudible), we feel really good about the overall business, as it stands right now and we anticipate obviously strong clip as we've talked about before. The clip is on a great momentum path right now and the ablation business both open and MIS are solid as well in the United States. We do anticipate the China will come back in a good way and Europe will remain strong for the year.

So I mean we feel really confident with the overall guidance. It's not that much wider. I think it's a pretty close and similar percentage differential from last year. So I think we're pretty aligned with kind of the way we gave our guidance last year.

Rick Wise -- Stifel -- Analyst

Got it. And then just on the China order for the fourth quarter the absence (ph) it was, is there any way that you can quantify that?

Mike Carrel -- President and Chief Executive Officer

Yeah, it's really quite frankly not that material to the overall number. It did obviously have an impact on the international growth rate, because international represents only 20% of our business. So, it did have the impact on that, but we're not -- we don't give specifics by country, per se, but we do feel really good about how 2019 is going to come together. Baheal is doing a great job and we feel like we're in a really strong position there long-term.

Rick Wise -- Stifel -- Analyst

Got it and then just on the US MIS ablation business. You had a nice bounce back in the fourth quarter. I understand that you're hampered to some degree since you can go out and market CONVERGE or DEEP. But Mike. What are you focused on commercially in the MIS franchise in 2019, kind of what's your playbook ahead of the data for CONVERGE in 2020? Thank you.

Mike Carrel -- President and Chief Executive Officer

The focus for getting ready for CONVERGE and getting things in 2020 is really, number one, is as you are aware, we've got a robust clinical education team for the Maze IV program. It's world-class. I talked about in the call today how we just got the STS endorsement. Our team has just done a wonderful job. We are now making sure that we are ready to go with as robust if not want more robust plan. Once we get the PMA to begin to roll out that in a more aggressive way at that time. That's really the focus right now as to get ourselves ready and prepared and make sure that we're doing everything we can to have a safe and effective procedure long term there.

Rick Wise -- Stifel -- Analyst

Thanks so much.

Operator

Our next question comes from Jason Mills with Canaccord Genuity.

Jason Mills -- Canaccord Genuity. -- Analyst

Hi, Mike and Andy. Thanks for taking the question. Now, I am on the road, sorry about the background noise. Can you hear me OK?

Mike Carrel -- President and Chief Executive Officer

Yeah, you're good. Thanks, Jay.

Jason Mills -- Canaccord Genuity. -- Analyst

Great, thanks. So just a little bit about 2019, maybe we'll ask more broader target distant market question, Mike. In 2019, you're going to have a little bit easier comp of OUS. The small part of your business you have kind of coming back. So I'm wondering could you give us qualitatively some assumptions in terms of relative to your guidance, OUS you see it growing within that range, is that a faster growing in that range or slower growth in that range.

And then as I think about the US, tell me if I'm thinking about this wrong. The appendage management grow faster than the guidance range that you've given on an overall basis, it seems like the MIS, I think you've been cautious with respect to growth rates until you have a label. So I'm thinking about that perhaps at the lower end of the range if not a little lower in the lower end of the range -- that would be maybe a source of upside and then open. I suppose we think about it on the mid-to-high single digits but wondering -- and the second part of my question is pain management and what the opportunity is for incremental revenue for pain management -- correct me if I'm wrong, pain management is going to be recorded within open. So sorry about all the questions in there, but I think you can get them just.

Mike Carrel -- President and Chief Executive Officer

There is a lot packed in there. So I'll start with the first one getting the road things down here. So on the OUS side in terms of the growth rate, we anticipate that the growth rates both for OUS and US will be within the range. I mean, it will be consistent across that when you blend the various different companies and the puts and takes on all sides of things. We do anticipate that both will be at around that 9% to 13% range. So that's kind of how I would articulate that. As you look at the US, you are correct that on the clip side of things that is our primary -- I mean our fastest-growing franchise. We anticipate in 2019 that that will continue to be our fastest-growing franchise for the year. As we look at the other ablation pieces of it, I think we'll be solid for the year.

You mentioned it on the MIS side, you're right, it could be. It's a little bit more volatile overall on a quarterly basis, but I think as we look over the course of the whole year, I think open and MIS will be reasonably consistent. And then when you talk about pain management, we don't have a ton in their own pain management at this time. We're excited about the opportunity. It's really a big 2020 opportunity as we build out the team this year, maybe the back part of the year, as things begin to rollout, we just rolled out the new product. We've got the team in place now. That's beginning to go there. We're ramping up that team in the first half through the third quarter of this year and we anticipate probably one of a ton of impact on revenue this year, but for sure should have an impact on revenue in 2019 for us. And then I think the last thing you asked was around the -- where it's going to fall in terms of on an external reporting basis, we're actually still working through how that's going to come out whether it's going to be in the open or in the other bucket, but we'll make sure that we talk about that in the next call.

Jason Mills -- Canaccord Genuity. -- Analyst

Okay. And I was struck by the attachment rate in the CONVERGE, Mike, love your -- more color on your thoughts there, I'm guessing you're pleasantly surprised, but tell me if I am thinking about this incorrectly. Longer term, you've talked about the MIS opportunity is being the largest TAM (ph), and if the CONVERGE -- if the attachment rates for appendage management stay at this level, the TAM for appendage management is fairly low penetration as well even as it stands today after a big run.

Do you expect the attachment rate to moderate some over time, or as you get into '20, '21, '22 and you see hopefully the data are good and the business builds in MIS, you see appendage management growth continuing to be strong in large part because of its attachment rate to MIS. Thank you very much. And Congrats on a great quarter.

Mike Carrel -- President and Chief Executive Officer

Thank you. I mean, I think you're asking a real quick question around the -- for the clip and the clip has continued to be an incredibly strong performer for us, so we do anticipate that the attachment rate will continue to be strong and only grow more and more data is coming out. There is positive data about managing the appendage and that's obviously helping that franchise. We do know that our product works and it works incredibly well at closing off that appendage.

And so -- and we're looking for other types of advantages with the clip as well from a labeling standpoint as we look into the future years. So we're excited about the clip opportunity. You're absolutely correct that we anticipate attachment to continue to grow into that -- not only this year, but into 2020 and 2021. On top of that, we've continued to innovate and better manage. It's tough to really talk about exactly what dollar amount is related to really innovation that we do, but bringing out the V clips, the new handle base is really made it much easier for more surgeons to be able to use our products on a more regular basis during their other procedures. And that's really driven a lot of our growth as well, which is that consistent innovation, people know that we're dedicated to this area, this is what we do every single day and that focus is really paying dividends for us.

Operator

Thank you. And our next question comes from Mike Matson with Needham & Company.

Mike Matson -- Needham & Company -- Analyst

Hi, thanks for taking my questions. I guess I just want to ask about the penetration of the newer V versions of AtriClips. And I don't know if you give us a number, but just as you start to lap the launches there, I don't remember exact timing on that, but do you expect those to continue to contribute to favorable mix in that business?

Mike Carrel -- President and Chief Executive Officer

And on both -- a great question. On both sides of it, we do see the Pro V, which was the one that we launched originally, that was the first one that is for the MIS side of things, we see more and more attachment to perfectly two different types of procedures. The conversion procedure for sure. So as convergent grows and as we gain attachment, the Pro V is really the preferred route that (inaudible). On top of that also for patients that are undergoing mitral valve surgery and it kind of goes through the transverse sinus from right side whey they are doing mini mitrals, that is another area where we see the V is the preferred method over the other ones, just because it's got a much smaller profile and easier to get through those tight spaces.

So that's really kind of getting new surgeons on board relative to that. On top of that, on the FLEX V, that product is just so easy to use. It's got an automatic release of the clip on -- where before you had to basically cut the sutures. It's made it a lot simpler, it's also ergonomically doesn't put as much pressure on the hand. So we're seeing that people just weren't willing or wanting to use the clip before because it was (inaudible) and more difficult to use, are now basically getting into that area, a lot of them are going into CABG patients. So we anticipate that that will continue to grow as well for the foreseeable future and be a big contributor to us long term.

Andrew Wade -- Senior Vice President and Chief Financial Officer

So I guess the short answer is that the mix benefit you're getting from the higher prices on those products can carry on beyond just the, kind of, first 12 months of the product being on the market -- products being on the market.

Mike Carrel -- President and Chief Executive Officer

There's a little mix in the price. But I mean most of our growth quite frankly is volume based. I mean we have a volume-based convergent (ph) people.

Mike Matson -- Needham & Company -- Analyst

Okay. Alright.

Mike Carrel -- President and Chief Executive Officer

So that it's getting into new procedures. Yes, there are more procedures. But quite frankly, I mean, the other thing is that people that used to use the old product, they are still using the old product, we're not necessarily taking them out, because they're liking it. They're happy with the costs or happy with the results, because it's a wonderful, wonderful product. We still saw more of that product than anything else. And so -- and then the volume has to continue to go up for a long time, kind of the price is a really small portion of it, it's really -- we're getting new cases that we just didn't get before.

Mike Matson -- Needham & Company -- Analyst

Yeah. Okay, got it. And then there was a comment made about the CONVERGE data being released in advance of a panel in 2020. So does that mean that we're definitely not going to see it in 2019 or that's just where your best guess is right now for timing.

Mike Carrel -- President and Chief Executive Officer

I don't imagine, you'll see -- I mean just I'll walk through timeline. I think it is helpful for a pretty good just to make sure this complete clarity on timeline of this. So the last patient we treated was August 21st of 2018. Therefore, the last patient to be treated or to follow-up is going to be within 30 days of that give or take, both either before or after, so say sometime end of August, early September that patient will be treated. We'll then compile all of the data in the fourth quarter and then we'll be ready to go to the FDA. There's really two pass at the FDA. We might have to go to panel, or if we don't go to panel and you get the approval, you'll get the dates and time of the approval. If you go to panel and you have to -- obviously you're presenting the results of on that front, then you will release the data basically the day we're going to panel and that's typically how they've done it in the of space. If you look at all of the other catheter-based technologies that were approved for paroxysmal, that's exactly how they release the data and we will be consistent with that to make sure that we're in line with how the FDA wants to look at. And again, this is all estimated, but so what do I anticipate is, we anticipate sometime in 2020, not the end of this year for sake is will be compiling the data to send the information to the FDA.

Mike Matson -- Needham & Company -- Analyst

Okay, thanks. And then just finally wanted to see if you could talk a little bit more about the cryoSPHERE probe launch and the team that you've put together there maybe the size of that. If you want to disclose that, how many (inaudible) you are planning to add this year. Thanks.

Mike Carrel -- President and Chief Executive Officer

So, we've built out the small CryoSPHERE team last year -- cryo nerve block team last year. Obviously, the existing probe or the over probe. The professional probe which is rolled up 2.5 weeks ago with our sales team as we announced. And also we have -- we are extending that team. We had four reps last year. We anticipate at least doubling that this year with the potential going larger than that to make sure that we're covering all the cases and getting into those spaces. And so we're going to build out that team commercially, continue to invest in clinical data and getting more clinical data and that team is really focused on the thoracic market. And so we're pretty excited about it, but again we think it's going to take kind of the beginning part of this year to really kind of make sure we're getting that launch up and running and going, but we do think long-term it's going to have great results on patient number one and number two (inaudible) some good results for our financials.

Mike Matson -- Needham & Company -- Analyst

All right. Thank you.

Operator

Our next question comes from Matt O'Brien with Piper Jaffray.

Kevin -- Piper Jaffray -- Analyst

Hi, Mike and Andy, this is Kevin on for Matt today. Thank you for your time. My first question is on the MIS side, as I look at some of the numbers, but I think it decelerated a little bit if you look at on a comp adjusted basis for 2018. Is there anything specific to point out there and then going into next year, as some of the clinicians are waiting for on-label, do you anticipate any kind of a slowdown as that dynamic plays out or just help us think through the growth rate currently and then kind of going into '19.

Mike Carrel -- President and Chief Executive Officer

Yeah, I mean, as we talked about earlier. First of all trying to make it really clear and our products are on label today for cardiac ablation. So that's being used on label today. What we're doing is we're going for a more advanced label and that's really what allows us to get more aggressive in some of the training programs, et cetera we talked about. So that's really kind of what this data is going to help provide when we go to the FDA, et cetera. As it relates to the growth rates, we anticipate we've talked about it before because of that and we're not able to kind of go full throttle on things for obvious reasons. What we have to do is, it's a little bit more volatile on the MIS side, but we anticipate that the growth rates will be consistent with what the growth rates were in the -- with the open business overall and that the clip business will drive the upside overall for the range we gave on the 9% to 13%, but we're not going to give specifics by different category like that.

Kevin -- Piper Jaffray -- Analyst

Okay, that still helpful directionally, thank you for that. My last question is, and most of mine have been asked, but I don't think that this is that big of a deal because you're so under-penetrated in CABG, but how do you think about the business in terms of surgical volumes, i.e., on the aortic side with the upcoming (inaudible) low-risk data. Is that something that you think about the company and just kind of walk us through that and how you think about it if you do at all?

Mike Carrel -- President and Chief Executive Officer

I mean of course we think about it. Because obviously, I mean we have to be thinking about all the different procedures where patients have a 7 surgical AVRs or patients that have -- that we're going to basically have to figure out, obviously as they go into that area, but quite frankly, the markets are so big and we're so under-penetrated across the board. Still less than 30% of the patients that have Afib, they are on the operating table are not getting treated. Now the good news is that number is up considerably from five, six years ago when that number was closer to 15% and so we anticipate that we're going to continue to work with our education and training programs to get greater and greater attachment. Like you said, CABG is a big opportunity for us. Quite frankly even AVRs are big opportunity. Patients that have Afib, it's been shown that if you have Afib, you actually should get treated and should go down the AVR path and so more and more of the Afib patients are kind of getting sen to surgery as a result of that. And so a lot of the patients that are going in for the (inaudible) if they've got the Afib, they're typically not getting treated and again being pushed over to the (inaudible) side of things.

That's not the case in every institution. Sometimes, we'll do follow-up Afib procedures later on. And so the way we look at it is that there is a huge underpenetration issue here. We've talked about that for years and got next question. We still think it's under-penetrated and we still think there's lots of opportunity for growth on the open side of our business.

Kevin -- Piper Jaffray -- Analyst

Okay, perfect. Thank you so much.

Operator

Our next question comes from Rebecca Wang with STB Leerink.

Rebecca Wang -- Leerink Partners -- Analyst

Hi guys. Thank you for taking my question. So I want to ask a high-level question on your ICE side of the business. So now you guys already have CONVERGE completely enrollment and then you make progress in the DEEP (ph) trial. So what is the role of the DEEP procedure in my eyes and how should we think about now you have to procedure in this business? Thank you.

Mike Carrel -- President and Chief Executive Officer

Yeah, I mean, it's a great question. So we have philosophically -- the way that we're building the business is to be able to provide a lot of tools for the physicians to choose from. And so some physicians do like the DEEP procedure a lot better. There is a huge cohort of electrophysiologists and cardiologists that believe that that is the right procedure. So we're investing in a clinical trial to get the advance labeling on that side. It is a market in and of itself. And then for a little less invasive approach, convergent is really where that comes in and for EPs that kind of want to take out the backlog (ph) and deal with the substrate associated with that. So it comes down to EP preference, some sites actually offer both. So they can be able to offer that to their patients. I see that happening more and more today, because patients want choices and these hospitals want to be able to provide those choices, especially the larger institutions want to be able to be a full service to be able to say, you can get -- you can basically choose between these different items. That's why it's really important for us to have both and to get the data associated with both, so that they can make really concrete decisions relative to that.

Rebecca Wang -- Leerink Partners -- Analyst

All right, thank you, that's very helpful.

Operator

Our next question comes from Suraj Kalia with Northland Securities. Suraj, your line is open, you can ask your question. Your phone line is muted, could you please unmute the phone line. Okay, I'm not showing any further question at this time. I turn the call back over to Mike Carrel.

Mike Carrel -- President and Chief Executive Officer

Again, everyone thank you for joining. I look forward to seeing many of you as the year progresses at various different conferences and congresses. Thank you. And I look forward to great 2019.

Operator

Ladies and gentlemen, that concludes today's presentation. You may now disconnect and have a wonderful day.

Duration: 45 minutes

Call participants:

Lynn Lewis -- Investor Relations

Mike Carrel -- President and Chief Executive Officer

Andrew Wade -- Senior Vice President and Chief Financial Officer

Rick Wise -- Stifel -- Analyst

Jason Mills -- Canaccord Genuity. -- Analyst

Mike Matson -- Needham & Company -- Analyst

Kevin -- Piper Jaffray -- Analyst

Rebecca Wang -- Leerink Partners -- Analyst

More ATRC analysis

Transcript powered by AlphaStreet

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

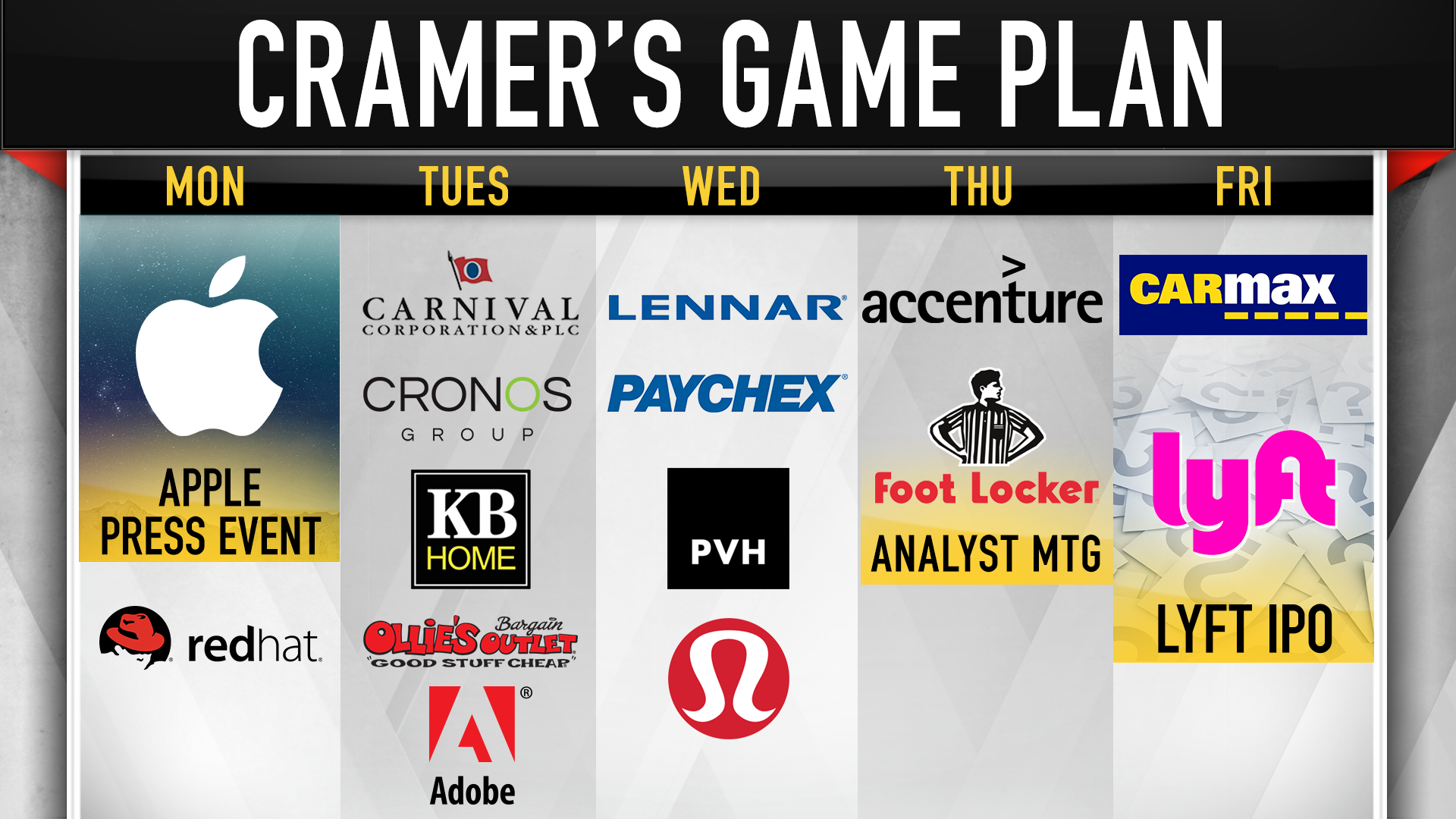

Cramer's game plan: 'Get ready to ride through these troubled waters' 1 Hour Ago | 11:32

Cramer's game plan: 'Get ready to ride through these troubled waters' 1 Hour Ago | 11:32

Source: Shutterstock

Source: Shutterstock  Source: Shutterstock

Source: Shutterstock  Source: Marriott Select Service Hotels via Flickr (Modified)

Source: Marriott Select Service Hotels via Flickr (Modified)  Source: Shutterstock

Source: Shutterstock  Source: Shutterstock

Source: Shutterstock  Symrise (FRA:SY1) has been given a €80.00 ($93.02) price objective by equities research analysts at Baader Bank in a report issued on Wednesday. The brokerage currently has a “buy” rating on the stock. Baader Bank’s price target indicates a potential upside of 1.50% from the stock’s previous close.

Symrise (FRA:SY1) has been given a €80.00 ($93.02) price objective by equities research analysts at Baader Bank in a report issued on Wednesday. The brokerage currently has a “buy” rating on the stock. Baader Bank’s price target indicates a potential upside of 1.50% from the stock’s previous close.

Kirby Co. (NYSE:KEX) Director Richard Ross Stewart sold 2,500 shares of the business’s stock in a transaction on Friday, March 1st. The stock was sold at an average price of $74.67, for a total transaction of $186,675.00. Following the completion of the sale, the director now owns 19,831 shares in the company, valued at approximately $1,480,780.77. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link.

Kirby Co. (NYSE:KEX) Director Richard Ross Stewart sold 2,500 shares of the business’s stock in a transaction on Friday, March 1st. The stock was sold at an average price of $74.67, for a total transaction of $186,675.00. Following the completion of the sale, the director now owns 19,831 shares in the company, valued at approximately $1,480,780.77. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link.